¿A favor de la nacionalización? – Parte II – Willi Noack – 16.6.2005

¿A favor de la nacionalización? Parte II

Although 2004 production of approximately 10 bcm/yr (358 bcf/yr) is relatively low in comparison to its substantial reserves base, output had been predicted (in the late 1990s) to increase significantly, driven by near double-digit demand growth from its southern cone neighbours (Argentina and Brazil). We estimate that only 10% of Bolivian gas production is utilised in the domestic market whilst the remainder is exported via two key pipelines into Argentina and Brazil, highlighting the importance of these demand centres to Bolivia’s future economic development (see Figure 2)

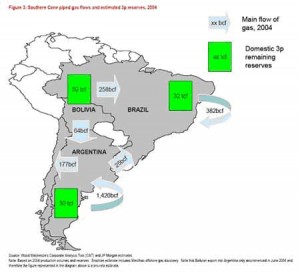

Although 2004 production of approximately 10 bcm/yr (358 bcf/yr) is relatively low in comparison to its substantial reserves base, output had been predicted (in the late 1990s) to increase significantly, driven by near double-digit demand growth from its southern cone neighbours (Argentina and Brazil). We estimate that only 10% of Bolivian gas production is utilised in the domestic market whilst the remainder is exported via two key pipelines into Argentina and Brazil, highlighting the importance of these demand centres to Bolivia’s future economic development (see Figure 3).

This scenario for demand growth was the driver behind the construction of the Bolivia-Brazil Pipeline (BBPL) as well as expansion plans for the main existing line into Argentina and construction of a major new pipeline into northern Argentina. Indeed, the optimism for the development of a fully liberalised southern cone gas matrix prompted several companies to propose significant investment plans in Bolivia’s upstream sector including Petrobras, BG, BP, Total and Repsol.

However, this scenario for demand growth did not envisage the economic collapse in Argentina, which resulted in exports into Argentina effectively ceasing in 2003, or the weaker-than-expected call on gas volumes from Brazil since 2001. As a result, utilisation in the take-or-pay BBPL is currently only running at just over two-thirds of its 30 Mcm/d capacity, whilst plans for a major new 20 Mcm/d pipeline into

Argentina have been frozen.

Demand growth looked set to take off again this year when the Argentinean government agreed to raise the price it paid for gas imports at the Bolivian border to US$2.00/mcf effective 1Q05. This price was viewed by many of the existing industry players as the level at which they would be prepared to kick-start the full exploitation of Bolivia’s substantial reserves base.

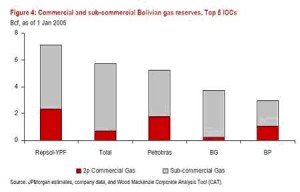

However, following the initial draft of the new hydrocarbon law in Bolivia, widespread civil unrest broke out and is now forcing key industry players to reconsider their current and future investments in the country. Given that the top 5 IOCs hold almost half of Bolivia’s 52 tcf of gas reserves, this would likely be a major blow to the prosperity of the country, in our view (see Figure 4)

Although the demand growth outlook for natural gas is now looking far more robust in neighbouring Argentina and Brazil, the outcome of the new hydrocarbon law in Bolivia is now of crucial importance. However, whilst domestic supply in Argentina will struggle to keep pace with demand, Brazil’s position looks less critical, in our view, particularly given the recent discovery of the 15tcf Mexilhao offshore gas field.

This places Argentina in more urgent need of a resolution than its Brazilian neighbour.

Should the Bolivian government sanction the additional 32% production tax, the only way to encourage investment, in our opinion, would be if prices for natural gas exports were to increase materially in order to offset the negative economic impact of the fiscal hike. However, we believe that neither of Bolivia’s neighbours has the capacity to cope with gas prices substantially in excess of the current levels of approximately US$2.00/mcf at both the Argentine and Brazilian borders.

In conclusion, it is clear that in the absence of substantial gas price increases (which, in our opinion, appears highly unlikely), the outcome of the new hydrocarbon law will be critical to the future prosperity of Bolivia. Under a harsher fiscal regime, the justification for significant new investment by foreign IOCs becomes far less compelling, in our view. Indeed, we believe that under the worst case scenario, a 50% royalty regime could see foreign operators exit the country completely.

fecha: 2005-07-29 14:53:47

autor: Willi Noack